AuthorGeorgia Cutbush - Founder of Swanson Advisory & Chartered Accountant with more than 10 years of professional experience including KPMG, Hilton Hotels and Scentre Group (Owner & Operator of Westfield) Archives

August 2021

Categories

All

|

Back to Blog

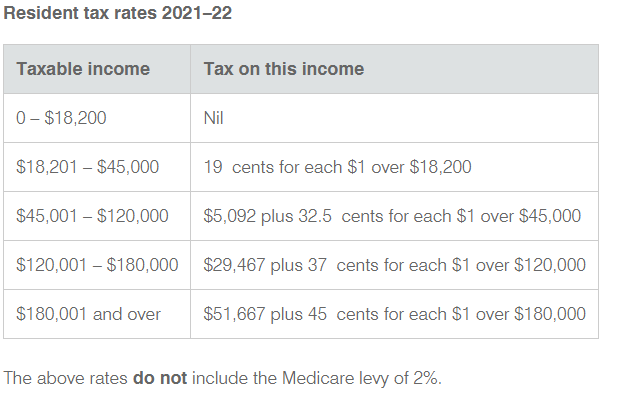

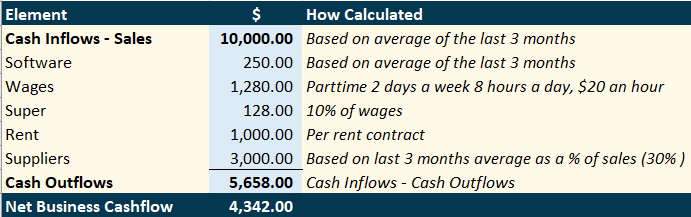

How to pay yourself as a Business Owner26/8/2021 Your business is just starting to hum and you have money coming through. Finally your efforts are paying off! Now you can think about paying yourself. Whilst it is tempting to transfer that hard earned cash straight into your personal bank account however, you need to consider a few essentials first. Unfortunately one of the main causes of business failure is failure to plan ahead. Not you though! You are doing your homework. Your business and your future self will thank you for reading this article. Before you pay yourself, you must take into account five critical elements: your business cashflow needs, cash reserves, business growth fund, taxes and superannuation. This article will help you critically analyse each of these items and calculate how much you can afford to pay yourself. Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - SuperThere is a lot to consider. We recommend you go step by step through the elements of the above equation. Business CashflowThe last thing you want to do is take too much money from your business, leaving it unable to pay its upcoming bills. Cashflow is vital to small businesses; you should view it as your blood flow. A cashflow budget is a great tool to utilise to ensure that your business will have adequate cashflow to keep functioning. Inflows Let's consider how your business gets cash. Do you have regular customers? Do you have customers that pay you on a weekly/monthly basis? Are there historic trends that can help you determine likely future cash inflows? Ideally you want to get as much money into your business as fast as possible. Do you have customers that don't pay or are slow payers? Some simple strategies can fix this. Your customers are busy too and they may simply have forgotten to pay you. Sometime it requires only a gentle prompt. Did you know that you can set up your accounting software to automatically do your debt collecting for you? Payment reminders can be set up to send a gentle nudge to your customers. This will save you time and allow you to focus on actual problem clients. If the gentle prompts aren't working it may be worthwhile considering upfront payments or offering discounts for on-time payment for large customers going forward. Outflows You need to know what cash your business requires to run. Common outflows include suppliers, software subscriptions, wages, insurance, GST, income tax (we will talk more about this later). Is there a regularity to your outflows? Consider weekly wages, monthly software subscription payments, annual insurance premiums. What are the payment terms? Are there any discounts for paying early or penalties for paying late? You want to make the most of the cash in your business. Net Cashflow Once you have determined your inflows and outflows you can determine the net cashflow of a business. Pick a period that works best for you eg monthly or weekly, add up your cash inflows and minus your cash outflows. For the moment do this excluding income tax (we will discuss this later). This is your net cashflow for the period. We recommend keeping in reserves at least a month of cash outflows as a buffer for your business. Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - SuperCash ReservesJust as you don't empty your personal bank account each month you shouldn't empty out your business bank account either. Why? You want to be able to protect your business from unforeseen events and rainy days, like lockdowns. How much should I keep in reserves? Great question. This will be different for every business. The business outflows you calculated about will be a great help in determining this. We recommend stockpiling at least one month of business cash outflows. That way if your business was to receive no income over the next month you would still be able to meet your out flows. Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - SuperGrowth FundGenerally you have to spend money to make money. But you want to do this wisely. You should be setting aside part of your business profits to spend on making your business grow. Growth funds should be spent to make your business more efficient or effective. Efficient Investing in better systems or equipment will allow you to service more customers or customers faster. For example investing in a new coffee machine allows you to make twice as many coffees in the same time, or investing in good accounting software allows you to invoice your clients faster, reducing time spent on financial admin and speeding up the potential for cash to arrive in your business bank account sooner. Effective Invest in projects that allow you to provide better services or goods to your customers. This could be investing in training for you or your team or a new marketing campaign. You can't effectively service your customers if they don't know about you. We recommend making a list of potential growth purchases and prioritising it in accordance with what will make the biggest impact to your business. Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - SuperTaxUnfortunately taxes can't be avoided. How much tax you pay depends on your entity structure and whether you have other income sources. We will explore this by looking at two of the most common structures for small businesses, Sole Traders and Companies. Sole Traders Many small businesses start as sole traders as they are the simplest entity to set up. As a sole trader your business is effectively an extension of you. Tax wise you are treated as one in the same. Your business profits are therefore taxed at individual tax rates. Business profit is calculated by adding the income generated by your business less the business expenses required to generate that income. Shown below are the current Individual tax rates for Australian Residents for the 2021/22 tax year. For current rates please refer to the ATO website. As a sole trader it is important to be aware of any other income you are earning as this will push up the tax payable on your business profits. I find examples the best way to understand. For example if you also have a part time job and earn a salary of $30,000 a year and have business profits of $20,000, then your taxable income is $50,000. Simplistically every dollar of your business profits is taxed at 32.5% plus 2% medicare levy. If you calculate the tax on taxable income of $30,000 (just the salary component) and then $50,000 (the full taxable income) the difference between the tow shows that for the business profits of $20,000 effectively $4,874.87 of tax would be payable. Let's look at this same example but with no salary. Your business profits of $20,000 is equivalent to your taxable income. Therefore the first $18,200 is tax free! Between $18,201-$45,000 your business profits are taxed at 19% (no medicare levy is payable for the 2021/22 year if your taxable income is less than $23,226). For the same business profit you are now paying tax of only $342. Company If you run your business through a company then you will pay tax on your first dollar of profit. The current company tax rate in Australia is 30% however many small businesses actually fall under the classification of a base rate entity. For the 2021/22 year base rate entities pay tax at 25%. More details about base rate entities can be found here. For example if business profits of $20,000 were achieved for the year and your business is a base rate entity, tax of $5,000 would be payable. Utilising Individual tax rates with a company structure As you can see from the above examples if the only income you have is the $20,000 of business profits in a company structure you are $4,658 worse off ($5,000 -$342). However if you pay yourself a director's fee or wage this becomes a tax deduction in the company and reduces the company's profit and also its taxable income. This wage is then assessable to you at the individual level. See the below example. You have business profits of $20,000 and choose to pay a director's fee equivalent to the tax free threshold of $18,200, your company will also be required to pay super at current 10% rates. Let's see how much tax is payable at the individual and company level. Individual Taxable Income = $18,200 and no tax is payable assuming no other income Company Taxable income = $20,000 Business profits - $18,200 wage - $1,820 super = $-20. The company is now in a loss, so no income tax is payable. Total tax payable = $0 Based on current tax rates the above strategy will provide benefits up to individual wages of $90,000 where the average tax rate is 24% as opposed to the company rate of 25%/30%. Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - SuperSuperIf you have been an employee it is likely that your employer would have paid super for you. Super is money invested for your future so that you do not have to depend on the government pension or work for the rest of your life. Whilst super is mandatory for employees over 14 earning more than $450 a month (per current requirements), if you are a sole trader there is no requirement to pay super. Whilst it isn't required it doesn't mean you should not pay it. Think of it as investing in future you. You also get a tax deduction for paying super. Who doesn't like paying less tax? We recommend paying super at similar rates to those as if you were an employee, currently super is paid at 10% of your wage. If you have calculated that your business can afford to pay out $1,200 a week, then you should be sending $109 to super and keeping $1,090 for yourself. Putting it all togetherYour Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - SuperThere is a lot to take in here especially if you are new to business. Let's see how this all works with an example to help you apply it to your own business. Sarah is a sole trader and runs a coffee cart. She mans the cart most days but employs a friend to help run her cart 2 days a week, 8 hours a day at $20 an hour. Based on the past 3 months of business Sarah has averaged $10,000 in income. Her monthly software subscriptions are $250 a month and pays $250 a week rent for the location of her coffee cart. She estimates she pays 30% of her sales to suppliers. Sarah has calculated her Net Business Cashflow as follows: Sarah has $3,000 currently in her business bank account and therefore realises she needs to keep an additional $2,530 to build up her Cash Reserves to ensure that she has a month of cash outflows. Sarah wants to buy a new coffee machine if she puts away $300 for the next three months she'll be able to afford this. This becomes her Growth Fund. Sarah as a list of other purchases she wants to make after the coffee machine, so would like to continue to save at least this amount going forwards. Sarah plugs these numbers into the formula and realises that she has $1,384 left to pay herself her super and taxes. Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - SuperYour Pay = $4,342 - 2,530 - 300 - Tax - SuperYour Pay = $1,384 - Tax - SuperIn this case Sarah's business profit is her net monthly cashflow x 12 plus her business insurance of $2,000 . She calculates her likely business profits to be $4,342 x 12 - $2,000 = $50,104. As a sole trader she is taxed at individual rates . She has no other income and using the above tax tables work out her tax = (50,104-45,000) x 32.5%+5,092+50,104 x2% = $7,752.88 for the year. She divides this by 12 to work out a monthly equivalent of $646.07. Your Pay = $1,384 - 646.07 - SuperYour Pay = $737.93 - SuperSarah wants to invest in her future and will pay super as if she was an employee at 10%. Sarah divides $737.93 by 1.1 to work out her monthly wage is $670.84, with super payable of $67.08. The following month as Sarah has now built up her cash reserves she can afford to pay herself more. the equation now becomes: Your Pay = $4,342 - 0 - 300 - 646.07 - SuperYour Pay = $3,395.93 - SuperTo calculate her wage Sarah divides $3,395.93 by 1.1 to work out her monthly wage is $3,087.21 and super payable of $308.72. Of course you do not have to take the whole amount as a wage you may choose to add a larger buffer to your cash reserves or growth fund or even purchase that first item off your growth purchases list.

If you have any questions please feel free to reach out. If you have enjoyed what you have read and would like to continue your financial business education journey check out our Financial Business Coaching. Liability limited by a scheme approved under Professional Standards Legislation

3 Comments

read more

Swanson Advisory

11/10/2021 03:35:37 pm

Hi IVM,

Reply

Leave a Reply. |

RSS Feed

RSS Feed