Before you pay yourself, you must take into account five critical elements: your business cashflow needs, cash reserves, business growth fund, taxes and superannuation. This article will help you critically analyse each of these items and calculate how much you can afford to pay yourself.

Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - Super

There is a lot to consider. We recommend you go step by step through the elements of the above equation.

Business Cashflow

The last thing you want to do is take too much money from your business, leaving it unable to pay its upcoming bills. Cashflow is vital to small businesses; you should view it as your blood flow. A cashflow budget is a great tool to utilise to ensure that your business will have adequate cashflow to keep functioning.

Inflows

Let's consider how your business gets cash. Do you have regular customers? Do you have customers that pay you on a weekly/monthly basis? Are there historic trends that can help you determine likely future cash inflows?

Ideally you want to get as much money into your business as fast as possible. Do you have customers that don't pay or are slow payers? Some simple strategies can fix this. Your customers are busy too and they may simply have forgotten to pay you. Sometime it requires only a gentle prompt. Did you know that you can set up your accounting software to automatically do your debt collecting for you? Payment reminders can be set up to send a gentle nudge to your customers.

This will save you time and allow you to focus on actual problem clients.

If the gentle prompts aren't working it may be worthwhile considering upfront payments or offering discounts for on-time payment for large customers going forward.

Outflows

You need to know what cash your business requires to run. Common outflows include suppliers, software subscriptions, wages, insurance, GST, income tax (we will talk more about this later).

Is there a regularity to your outflows? Consider weekly wages, monthly software subscription payments, annual insurance premiums. What are the payment terms? Are there any discounts for paying early or penalties for paying late?

You want to make the most of the cash in your business.

Net Cashflow

Once you have determined your inflows and outflows you can determine the net cashflow of a business. Pick a period that works best for you eg monthly or weekly, add up your cash inflows and minus your cash outflows. For the moment do this excluding income tax (we will discuss this later). This is your net cashflow for the period. We recommend keeping in reserves at least a month of cash outflows as a buffer for your business.

Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - Super

Cash Reserves

Just as you don't empty your personal bank account each month you shouldn't empty out your business bank account either. Why? You want to be able to protect your business from unforeseen events and rainy days, like lockdowns.

How much should I keep in reserves? Great question. This will be different for every business. The business outflows you calculated about will be a great help in determining this. We recommend stockpiling at least one month of business cash outflows. That way if your business was to receive no income over the next month you would still be able to meet your out flows.

How much should I keep in reserves? Great question. This will be different for every business. The business outflows you calculated about will be a great help in determining this. We recommend stockpiling at least one month of business cash outflows. That way if your business was to receive no income over the next month you would still be able to meet your out flows.

Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - Super

Growth Fund

Generally you have to spend money to make money. But you want to do this wisely. You should be setting aside part of your business profits to spend on making your business grow.

Growth funds should be spent to make your business more efficient or effective.

Efficient

Investing in better systems or equipment will allow you to service more customers or customers faster. For example investing in a new coffee machine allows you to make twice as many coffees in the same time, or investing in good accounting software allows you to invoice your clients faster, reducing time spent on financial admin and speeding up the potential for cash to arrive in your business bank account sooner.

Effective

Invest in projects that allow you to provide better services or goods to your customers. This could be investing in training for you or your team or a new marketing campaign. You can't effectively service your customers if they don't know about you.

We recommend making a list of potential growth purchases and prioritising it in accordance with what will make the biggest impact to your business.

Growth funds should be spent to make your business more efficient or effective.

Efficient

Investing in better systems or equipment will allow you to service more customers or customers faster. For example investing in a new coffee machine allows you to make twice as many coffees in the same time, or investing in good accounting software allows you to invoice your clients faster, reducing time spent on financial admin and speeding up the potential for cash to arrive in your business bank account sooner.

Effective

Invest in projects that allow you to provide better services or goods to your customers. This could be investing in training for you or your team or a new marketing campaign. You can't effectively service your customers if they don't know about you.

We recommend making a list of potential growth purchases and prioritising it in accordance with what will make the biggest impact to your business.

Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - Super

Tax

Unfortunately taxes can't be avoided. How much tax you pay depends on your entity structure and whether you have other income sources. We will explore this by looking at two of the most common structures for small businesses, Sole Traders and Companies.

Sole Traders

Many small businesses start as sole traders as they are the simplest entity to set up. As a sole trader your business is effectively an extension of you. Tax wise you are treated as one in the same. Your business profits are therefore taxed at individual tax rates.

Business profit is calculated by adding the income generated by your business less the business expenses required to generate that income.

Many small businesses start as sole traders as they are the simplest entity to set up. As a sole trader your business is effectively an extension of you. Tax wise you are treated as one in the same. Your business profits are therefore taxed at individual tax rates.

Business profit is calculated by adding the income generated by your business less the business expenses required to generate that income.

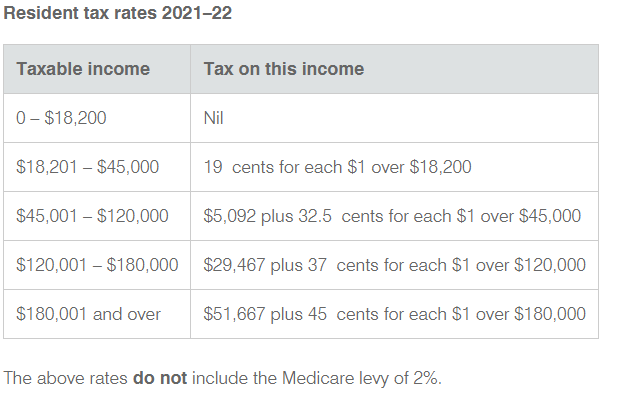

Shown below are the current Individual tax rates for Australian Residents for the 2021/22 tax year. For current rates please refer to the ATO website.

As a sole trader it is important to be aware of any other income you are earning as this will push up the tax payable on your business profits. I find examples the best way to understand.

For example if you also have a part time job and earn a salary of $30,000 a year and have business profits of $20,000, then your taxable income is $50,000. Simplistically every dollar of your business profits is taxed at 32.5% plus 2% medicare levy. If you calculate the tax on taxable income of $30,000 (just the salary component) and then $50,000 (the full taxable income) the difference between the tow shows that for the business profits of $20,000 effectively $4,874.87 of tax would be payable.

Let's look at this same example but with no salary. Your business profits of $20,000 is equivalent to your taxable income. Therefore the first $18,200 is tax free! Between $18,201-$45,000 your business profits are taxed at 19% (no medicare levy is payable for the 2021/22 year if your taxable income is less than $23,226). For the same business profit you are now paying tax of only $342.

For example if you also have a part time job and earn a salary of $30,000 a year and have business profits of $20,000, then your taxable income is $50,000. Simplistically every dollar of your business profits is taxed at 32.5% plus 2% medicare levy. If you calculate the tax on taxable income of $30,000 (just the salary component) and then $50,000 (the full taxable income) the difference between the tow shows that for the business profits of $20,000 effectively $4,874.87 of tax would be payable.

Let's look at this same example but with no salary. Your business profits of $20,000 is equivalent to your taxable income. Therefore the first $18,200 is tax free! Between $18,201-$45,000 your business profits are taxed at 19% (no medicare levy is payable for the 2021/22 year if your taxable income is less than $23,226). For the same business profit you are now paying tax of only $342.

Company

If you run your business through a company then you will pay tax on your first dollar of profit. The current company tax rate in Australia is 30% however many small businesses actually fall under the classification of a base rate entity. For the 2021/22 year base rate entities pay tax at 25%. More details about base rate entities can be found here.

For example if business profits of $20,000 were achieved for the year and your business is a base rate entity, tax of $5,000 would be payable.

Utilising Individual tax rates with a company structure

As you can see from the above examples if the only income you have is the $20,000 of business profits in a company structure you are $4,658 worse off ($5,000 -$342).

However if you pay yourself a director's fee or wage this becomes a tax deduction in the company and reduces the company's profit and also its taxable income. This wage is then assessable to you at the individual level. See the below example.

You have business profits of $20,000 and choose to pay a director's fee equivalent to the tax free threshold of $18,200, your company will also be required to pay super at current 10% rates. Let's see how much tax is payable at the individual and company level.

Individual Taxable Income = $18,200 and no tax is payable assuming no other income

Company Taxable income = $20,000 Business profits - $18,200 wage - $1,820 super = $-20. The company is now in a loss, so no income tax is payable.

Total tax payable = $0

Based on current tax rates the above strategy will provide benefits up to individual wages of $90,000 where the average tax rate is 24% as opposed to the company rate of 25%/30%.

If you run your business through a company then you will pay tax on your first dollar of profit. The current company tax rate in Australia is 30% however many small businesses actually fall under the classification of a base rate entity. For the 2021/22 year base rate entities pay tax at 25%. More details about base rate entities can be found here.

For example if business profits of $20,000 were achieved for the year and your business is a base rate entity, tax of $5,000 would be payable.

Utilising Individual tax rates with a company structure

As you can see from the above examples if the only income you have is the $20,000 of business profits in a company structure you are $4,658 worse off ($5,000 -$342).

However if you pay yourself a director's fee or wage this becomes a tax deduction in the company and reduces the company's profit and also its taxable income. This wage is then assessable to you at the individual level. See the below example.

You have business profits of $20,000 and choose to pay a director's fee equivalent to the tax free threshold of $18,200, your company will also be required to pay super at current 10% rates. Let's see how much tax is payable at the individual and company level.

Individual Taxable Income = $18,200 and no tax is payable assuming no other income

Company Taxable income = $20,000 Business profits - $18,200 wage - $1,820 super = $-20. The company is now in a loss, so no income tax is payable.

Total tax payable = $0

Based on current tax rates the above strategy will provide benefits up to individual wages of $90,000 where the average tax rate is 24% as opposed to the company rate of 25%/30%.

Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - Super

Super

If you have been an employee it is likely that your employer would have paid super for you. Super is money invested for your future so that you do not have to depend on the government pension or work for the rest of your life.

Whilst super is mandatory for employees over 14 earning more than $450 a month (per current requirements), if you are a sole trader there is no requirement to pay super. Whilst it isn't required it doesn't mean you should not pay it. Think of it as investing in future you. You also get a tax deduction for paying super. Who doesn't like paying less tax?

We recommend paying super at similar rates to those as if you were an employee, currently super is paid at 10% of your wage. If you have calculated that your business can afford to pay out $1,200 a week, then you should be sending $109 to super and keeping $1,090 for yourself.

Whilst super is mandatory for employees over 14 earning more than $450 a month (per current requirements), if you are a sole trader there is no requirement to pay super. Whilst it isn't required it doesn't mean you should not pay it. Think of it as investing in future you. You also get a tax deduction for paying super. Who doesn't like paying less tax?

We recommend paying super at similar rates to those as if you were an employee, currently super is paid at 10% of your wage. If you have calculated that your business can afford to pay out $1,200 a week, then you should be sending $109 to super and keeping $1,090 for yourself.

Putting it all together

Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - Super

There is a lot to take in here especially if you are new to business. Let's see how this all works with an example to help you apply it to your own business.

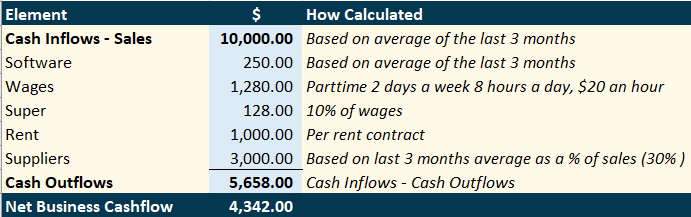

Sarah is a sole trader and runs a coffee cart. She mans the cart most days but employs a friend to help run her cart 2 days a week, 8 hours a day at $20 an hour. Based on the past 3 months of business Sarah has averaged $10,000 in income. Her monthly software subscriptions are $250 a month and pays $250 a week rent for the location of her coffee cart. She estimates she pays 30% of her sales to suppliers.

Sarah has calculated her Net Business Cashflow as follows:

Sarah is a sole trader and runs a coffee cart. She mans the cart most days but employs a friend to help run her cart 2 days a week, 8 hours a day at $20 an hour. Based on the past 3 months of business Sarah has averaged $10,000 in income. Her monthly software subscriptions are $250 a month and pays $250 a week rent for the location of her coffee cart. She estimates she pays 30% of her sales to suppliers.

Sarah has calculated her Net Business Cashflow as follows:

Sarah has $3,000 currently in her business bank account and therefore realises she needs to keep an additional $2,530 to build up her Cash Reserves to ensure that she has a month of cash outflows.

Sarah wants to buy a new coffee machine if she puts away $300 for the next three months she'll be able to afford this. This becomes her Growth Fund. Sarah as a list of other purchases she wants to make after the coffee machine, so would like to continue to save at least this amount going forwards.

Sarah plugs these numbers into the formula and realises that she has $1,384 left to pay herself her super and taxes.

Sarah wants to buy a new coffee machine if she puts away $300 for the next three months she'll be able to afford this. This becomes her Growth Fund. Sarah as a list of other purchases she wants to make after the coffee machine, so would like to continue to save at least this amount going forwards.

Sarah plugs these numbers into the formula and realises that she has $1,384 left to pay herself her super and taxes.

Your Pay = Net Business Cashflow - Cash Reserves - Growth Fund - Tax - Super

Your Pay = $4,342 - 2,530 - 300 - Tax - Super

Your Pay = $1,384 - Tax - Super

In this case Sarah's business profit is her net monthly cashflow x 12 plus her business insurance of $2,000 . She calculates her likely business profits to be $4,342 x 12 - $2,000 = $50,104. As a sole trader she is taxed at individual rates . She has no other income and using the above tax tables work out her tax = (50,104-45,000) x 32.5%+5,092+50,104 x2% = $7,752.88 for the year. She divides this by 12 to work out a monthly equivalent of $646.07.

Your Pay = $1,384 - 646.07 - Super

Your Pay = $737.93 - Super

Sarah wants to invest in her future and will pay super as if she was an employee at 10%. Sarah divides $737.93 by 1.1 to work out her monthly wage is $670.84, with super payable of $67.08.

The following month as Sarah has now built up her cash reserves she can afford to pay herself more. the equation now becomes:

Your Pay = $4,342 - 0 - 300 - 646.07 - Super

Your Pay = $3,395.93 - Super

To calculate her wage Sarah divides $3,395.93 by 1.1 to work out her monthly wage is $3,087.21 and super payable of $308.72. Of course you do not have to take the whole amount as a wage you may choose to add a larger buffer to your cash reserves or growth fund or even purchase that first item off your growth purchases list.

If you have any questions please feel free to reach out. If you have enjoyed what you have read and would like to continue your financial business education journey check out our Financial Business Coaching.

Liability limited by a scheme approved under Professional Standards Legislation

]]>If you have any questions please feel free to reach out. If you have enjoyed what you have read and would like to continue your financial business education journey check out our Financial Business Coaching.

Liability limited by a scheme approved under Professional Standards Legislation

Make sure you know your Director Duties

• Insolvent trading occurs when owners allow their businesses to incur debts when it is unlikely that they to they can pay for them

• Liquidators can make directors personally accountable for company debts

• Covid uncertainty means NOW is the time to make sure of your solvency.

Swanson Advisory can help you:

• Cashflow Forecasting to help you manage your upcoming cash obligations

• How to utilise 5 levers to maximise your profitability

To find out more about your director duties please visit ASIC's website https://asic.gov.au/regulatory-resources/insolvency/insolvency-for-directors/directors-what-are-my-duties-as-a-director/

]]>• Insolvent trading occurs when owners allow their businesses to incur debts when it is unlikely that they to they can pay for them

• Liquidators can make directors personally accountable for company debts

• Covid uncertainty means NOW is the time to make sure of your solvency.

Swanson Advisory can help you:

• Cashflow Forecasting to help you manage your upcoming cash obligations

• How to utilise 5 levers to maximise your profitability

To find out more about your director duties please visit ASIC's website https://asic.gov.au/regulatory-resources/insolvency/insolvency-for-directors/directors-what-are-my-duties-as-a-director/

GST requirements can be confusing! Make your next BAS the easiest one yet!

Read our guidance below to ensure you avoid the common pitfalls!

Click the below image to request a copy of our GST Quick Reference Guide.

Read our guidance below to ensure you avoid the common pitfalls!

Click the below image to request a copy of our GST Quick Reference Guide.

Tax Invoices

You must have a tax invoice to claim a GST credit for purchases that cost more than $82.50 (including GST). If your tax invoice does not specify the amount of GST included in the price of your purchase by only stating that the price includes GST, you can work out the GST amount yourself by dividing the price by 11. The answer is the amount of GST credit you can claim (provided you use the item wholly for business purposes).

You must have a tax invoice to claim a GST credit for purchases that cost more than $82.50 (including GST). If your tax invoice does not specify the amount of GST included in the price of your purchase by only stating that the price includes GST, you can work out the GST amount yourself by dividing the price by 11. The answer is the amount of GST credit you can claim (provided you use the item wholly for business purposes).

GST Free vs GST - NT

GST Free items are those that don't attract GST, such as raw food, healthcare services and water services. The GST N-T tax code should be used when the transaction is not reportable, for example: cash transfers between your business accounts, depreciation, directors fees, security deposits and most government charges.

GST Free items are those that don't attract GST, such as raw food, healthcare services and water services. The GST N-T tax code should be used when the transaction is not reportable, for example: cash transfers between your business accounts, depreciation, directors fees, security deposits and most government charges.

| Cash vs Accruals Know your reporting method. This is either Cash or Accruals and will affect the timing as to when you are required to declare the GST on your transactions. Smaller tax payers generally fall under the Cash Basis, as this matches their GST payments and refunds with their cash inflows and outflows. They are entitled to received GST credits (upon paying expenses) and required to pay GST (upon receiving cash from their customers). The accrual method on the other hand entitles you to receive the GST credit as soon as you have incurred the expenditure and requires you to pay the GST as soon as you provide the goods/services. |

Set Up Your Accounting System Correctly

Did you know that most accounting software allows you to set a default GST code for each separate account? This can be a big time saver if set up correctly and will help ensure that you are claiming the correct amount of GST. However, to claim GST you need to ensure that you receive a valid tax invoice (includes an ABN) and also shows that GST has been charged. It is best practice to attach these tax invoices to the relevant transaction in your accounting software.

Did you know that most accounting software allows you to set a default GST code for each separate account? This can be a big time saver if set up correctly and will help ensure that you are claiming the correct amount of GST. However, to claim GST you need to ensure that you receive a valid tax invoice (includes an ABN) and also shows that GST has been charged. It is best practice to attach these tax invoices to the relevant transaction in your accounting software.

Non Deductible Expenses = No GST Claimable

You cannot claim GST for any non-deductible expenses such as entertainment or private use portions of motor vehicle expenses. When you enter expenses which have a private portion, you can actually spilt the two portions of the expense between two separate accounts: one private with no GST claimable and one business-related with GST claimable. Ensure that you meet the ATO's record keeping requirements when determining the private portion of expenses. Refer to our resources section for a comprehensive ATO guide. These items should be coded as GST - NT ( Not Reportable).

You cannot claim GST for any non-deductible expenses such as entertainment or private use portions of motor vehicle expenses. When you enter expenses which have a private portion, you can actually spilt the two portions of the expense between two separate accounts: one private with no GST claimable and one business-related with GST claimable. Ensure that you meet the ATO's record keeping requirements when determining the private portion of expenses. Refer to our resources section for a comprehensive ATO guide. These items should be coded as GST - NT ( Not Reportable).

Bank Fees, Merchant Fees, Interest paid and received

No GST is charged or claimable on standard bank fees. However, GST is claimable on merchant fees, as this is actually a service. It is best practice to have separate accounts to recognise these expenses as they have different GST treatments. No GST is charged on interest paid or received.

No GST is charged or claimable on standard bank fees. However, GST is claimable on merchant fees, as this is actually a service. It is best practice to have separate accounts to recognise these expenses as they have different GST treatments. No GST is charged on interest paid or received.

Government Charges

No GST is charged on Motor Vehicle Registration, Land Tax, Council Rates, Water Rates, ASIC Fees or Stamp Duty. If you are in doubt you can refer to the tax invoice provided. These items should generally be coded as GST- NT apart from water rates, which are GST Free.

No GST is charged on Motor Vehicle Registration, Land Tax, Council Rates, Water Rates, ASIC Fees or Stamp Duty. If you are in doubt you can refer to the tax invoice provided. These items should generally be coded as GST- NT apart from water rates, which are GST Free.

Insurance Premiums

Insurance premiums may include a portion of stamp duty which as mentioned above does not attract GST. When entering transactions to record insurance premiums, ensure you refer to the tax invoice and separate the stamp duty portion into a different line item that is not applicable for GST.

Insurance premiums may include a portion of stamp duty which as mentioned above does not attract GST. When entering transactions to record insurance premiums, ensure you refer to the tax invoice and separate the stamp duty portion into a different line item that is not applicable for GST.

International Transactions

As GST is an Australian tax you will not be charged GST on transactions you incur whilst travelling overseas. Importation of goods valued at more than $1,000 will however attract GST. Generally GST is not required to be levied on the exportation of goods or services, as long as they are exported within 60 days of either the supplier receiving payment or issuing an invoice, whichever occurs first. The transaction is still required to be reported at G1 Total sales.

As GST is an Australian tax you will not be charged GST on transactions you incur whilst travelling overseas. Importation of goods valued at more than $1,000 will however attract GST. Generally GST is not required to be levied on the exportation of goods or services, as long as they are exported within 60 days of either the supplier receiving payment or issuing an invoice, whichever occurs first. The transaction is still required to be reported at G1 Total sales.

Keep your records

Keep all your tax invoices and other GST records for five years as per ATO requirements.

Keep all your tax invoices and other GST records for five years as per ATO requirements.

Request a copy of our GST Quick Reference Guide

Click the image below!

Click the image below!

Liability limited by a scheme approved under Professional Standards Legislation

]]>You need to act now to qualify for generous incentives such as, $150,000 instant asset deductions.

Don’t miss out! Organise your business expenses before the tax year ends on 30 June 2020

Time to qualify for $150,000 instant asset tax deductions

Is there a significant business asset that you have been thinking of buying for months? You could easily be entitled to a $150,000 instant tax deduction per asset for purchases made before 30 June. However, this deduction reduces to a mere $1,000 per asset after 31 December. If the asset costs more than the threshold, the deduction will have to be spread over the asset’s useful life, which could be 10 years.

Specific eligibility criteria applies, including:

Is there a significant business asset that you have been thinking of buying for months? You could easily be entitled to a $150,000 instant tax deduction per asset for purchases made before 30 June. However, this deduction reduces to a mere $1,000 per asset after 31 December. If the asset costs more than the threshold, the deduction will have to be spread over the asset’s useful life, which could be 10 years.

Specific eligibility criteria applies, including:

- assets must be installed and ready for use by 30 June 2020

- assets must be purchased for less than $150,000

- the $150,000 threshold applies for businesses with an aggregate turnover of less than $500 million

- car purchase deductions are limited to an asset value of $57,581.

Personal Super Contributions

Making additional superannuation contributions before June 30 could mean valuable extra tax deductions. Note these deductions are available only for contributions made out of after-tax funds, meaning that contributions paid by your employer or salary sacrificed do not qualify. Be careful, as you can contribute only $25,000 a year to super (which includes employer-paid and salary-sacrifice super). Significant penalties apply for exceeding this cap.

You must notify your superfund that you intend to claim this deduction and you must receive acknowledgement of this request from your fund. Further eligibility criteria can be found on the ATO's Website. Note, super deductions are only considered “paid” once they are received by your fund. For Employers this is also true make sure that your June super is paid prior to 30 June to be deductible this financial year, for those using the small business super clearing house payments are required to be made by 23 June 2020 to be deductible for the 30 June 2020 year.

Employee Super

Employers are required to pay their employees' super before 30 June to be deductible this financial year. For those using the ATO Small Business Super Clearing House, payments are required by 23 June 2020.

Making additional superannuation contributions before June 30 could mean valuable extra tax deductions. Note these deductions are available only for contributions made out of after-tax funds, meaning that contributions paid by your employer or salary sacrificed do not qualify. Be careful, as you can contribute only $25,000 a year to super (which includes employer-paid and salary-sacrifice super). Significant penalties apply for exceeding this cap.

You must notify your superfund that you intend to claim this deduction and you must receive acknowledgement of this request from your fund. Further eligibility criteria can be found on the ATO's Website. Note, super deductions are only considered “paid” once they are received by your fund. For Employers this is also true make sure that your June super is paid prior to 30 June to be deductible this financial year, for those using the small business super clearing house payments are required to be made by 23 June 2020 to be deductible for the 30 June 2020 year.

Employee Super

Employers are required to pay their employees' super before 30 June to be deductible this financial year. For those using the ATO Small Business Super Clearing House, payments are required by 23 June 2020.

Prepay Expenses

If your cashflow allows, you should consider pre-paying some of your business expenses for the 2020/21 financial year before 30 June 2020. Deductions are available for expenditure up to 12 months in advance if you are considered a small business entity. Common prepayments include insurance, subscriptions, professional memberships and rent.

Business Use of Personal Assets

A common missed tax deduction is not claiming the business use of your personal assets. Do you use your mobile phone for work? Do you need to drive your personal vehicle for work? Have you been working from home?

In recognition of COVID- 19 requiring many people to work from home, the ATO has introduced a shortcut method for claiming deductions for this. Provided that working from home was required to fulfil your employment duties and you were not carrying out minimal tasks such as checking your emails, you can claim a deduction of 80 cents for each hour worked from home between 1 March and 30 June 2020. This method covers internet, phone, stationery, computer consumables and other expenses. To qualify, you must keep a record of the of hours you have worked from home as a result of COVID-19, such as diary notes and timesheets. For further eligibility requirements, refer to the ATO's website.

Review Debtors

It's always good practice to review who owes you money. If you have been chasing debtors to no avail, you can write them off as a bad debt. This will increase your expenditure and lower your taxable profit.

If you have a lot of slow-paying debtors it may be time to consider factoring, where you receive a fraction of your outstanding debtor balances upfront (as high as 95%), while a debt recovery company chases the debts for you. Sometimes the debt collector will pay you a bonus once they collect.

Depreciation and Obsolete Assets

Do you maintain a listing of all your fixed assets? You may still be depreciating assets your business no longer uses. These assets could potentially be written off, bringing forward depreciation deductions that would otherwise be applied to future years.

Time Value of Money

The Time Value of Money is a statement you may have heard before. Essentially, it means money is more valuable to you today than the same amount tomorrow. This applies now more than ever. If you anticipate a tax refund, the sooner you have this money, the sooner you can use it for other purposes, which could be income-generating, such as buying new business assets or investing.

Countless other tasks and people will compete for your attention this June, but do yourself a favour and put tax at the top of your list. It could mean cash in your bank accounts six months sooner, which could also mean another six months of more productive equipment and higher sales, or six more months more of investment income.

If you have any questions about your tax please get in touch with Swanson Advisory or your existing accountant. Swanson Advisory is dedicated to helping you, your business and employees thrive!

Liability limited by a scheme approved under Professional Standards Legislation